deferred sales trust example

Current DST Properties and Sponsors. Take an elderly couple for example.

Installment Sale To An Idgt To Reduce Estate Taxes

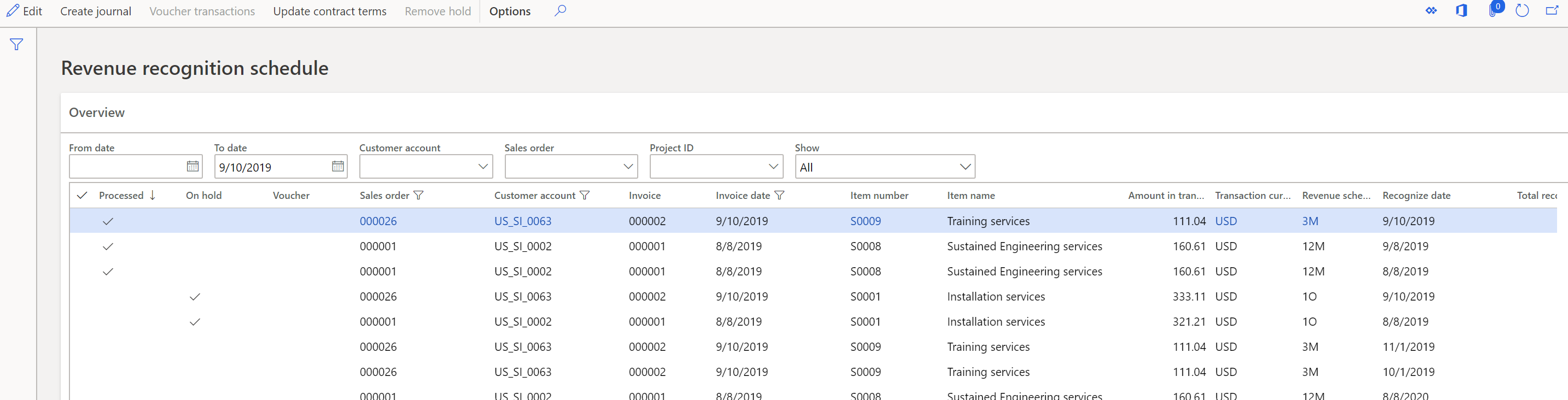

DST Deferred Sales Trust is a term for which the Estate Planning Team claims a common law.

. Ad Ensure All of Your Properties Are Listed for Your Loved Ones. Deferred Sales Trust DST looks like a tax conceptArguably it is but thats not all. An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST.

A Deferred Sales Trust can be a fantastic tool for minimizing your tax obligations and investing the savings to build your wealth. An emerging alternative to the 1031 exchange 1 wherein the taxpayer has the opportunity to defer the gain on a sale is a deferred sales trust DST. There are significant benefits in electing to use the Deferred Sales Trust when selling a property or capital asset.

By Greg Reese Certified Trustee for the Deferred Sales Trust. Yet any method for making money carries risk. The deferred sales trust specialists at Freedom Bridge Capital would be happy to speak with you to see if a DST is right for you.

Give an example of someone selling and we just did a deal in like the Santa Cruz area was a 79 million sale and they had about 26 million of liability of tax. Here is another example of a couple in California selling a highly appreciated residential property in California. Today we bring you Part 2 of our.

Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. Instead of receiving the sale proceeds at closing the.

The Deferred Sales Trust will defer taxes on your capital gains giving you control over your reinvestment terms. When the appreciated property or capital assets. Please give us a call at 800-897-0212 or request your free DST.

The Deferred Sales Trust gives you the ability to control your capital gains tax exposure reinvestment terms and installment payments made from the trust. It states that if Michelle is going to. A deferred sale trust is a vehicle used to defer capital gains tax when selling certain assets that are subject to the capital gains tax.

In the above example there would be no taxes due with a Deferred Sales Trust. Wners of businesses real estate and other highly appreciated assets are oft en reluctant to sell due to the signifi cant capital. Current DST Properties and Sponsors.

It works by having the money from a sales proceeding put into a trust. Unlike a 1031 exchange a DST does. Benefit of a Deferred Sales Trust The major benefit of the Deferred Sales Trust is tax deferral with the freedom to choose investment options.

A capital gains tax deferral strategy. Download and Print Instantly on Desktop Mobile and Tablets. Take an elderly couple for.

A Legal Tax-Based Strategy for Deferring the Payment of Capital Gains Taxes. All the deferred sales trust is a manufactured installment sale and its based upon a Tax Code called IRC 453 which goes back to the 1920s.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

A Checklist For Settling A Living Trust Estate Ameriestate

Deferred Sales Trust Capital Gains Tax Deferral

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

4 Risks To Consider Before Creating A Deferred Sales Trust Reef Point Llc

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Tax Deferred Cash Out Risks Are Much Lower Than Deferred Sales Trust

Tax Deferred Cash Out Risks Are Much Lower Than Deferred Sales Trust

Capital Gains Tax Deferral Capital Gains Tax Exemptions

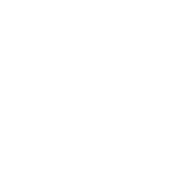

Recognize Deferred Revenue Finance Dynamics 365 Microsoft Docs

Selling My Business Capital Gains Tax Business Sale

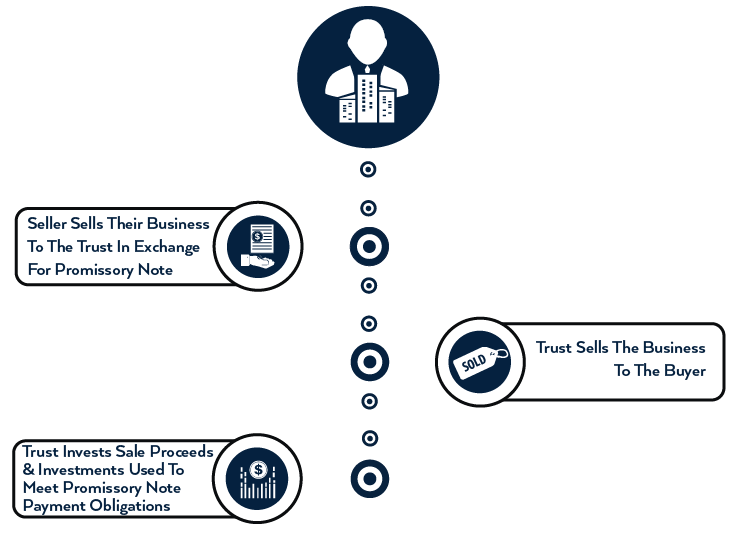

Charitable Remainder Trusts Crts Wealthspire

Deferred Sales Trust Oklahoma Bar Association

Deferred Sales Trust Defer Capital Gains Tax